net investment income tax repeal 2021

Lets look at two examples. Tax years after December 31 2021.

How To Calculate The Net Investment Income Properly

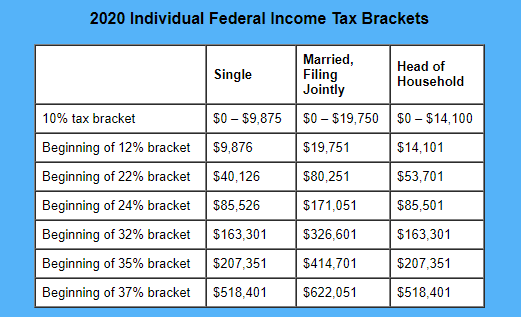

The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the.

. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. Tax Advantages For Donor Advised Funds. According to previously mentioned JCT.

For example if you filed your 2017 tax return by April 15 2018 the statute of limitations to file a protective claim for the 2017 tax year expires on April 15 2021. The plaintiffs argued that this change was fatal to the entire Affordable Care Act which would include the net investment income tax under IRC 1411 as the Supreme Court. Total section 1411 NOL allowed as deduction against.

Effective for tax years beginning after Dec. The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year. 3 Surtax 5 Not applicable.

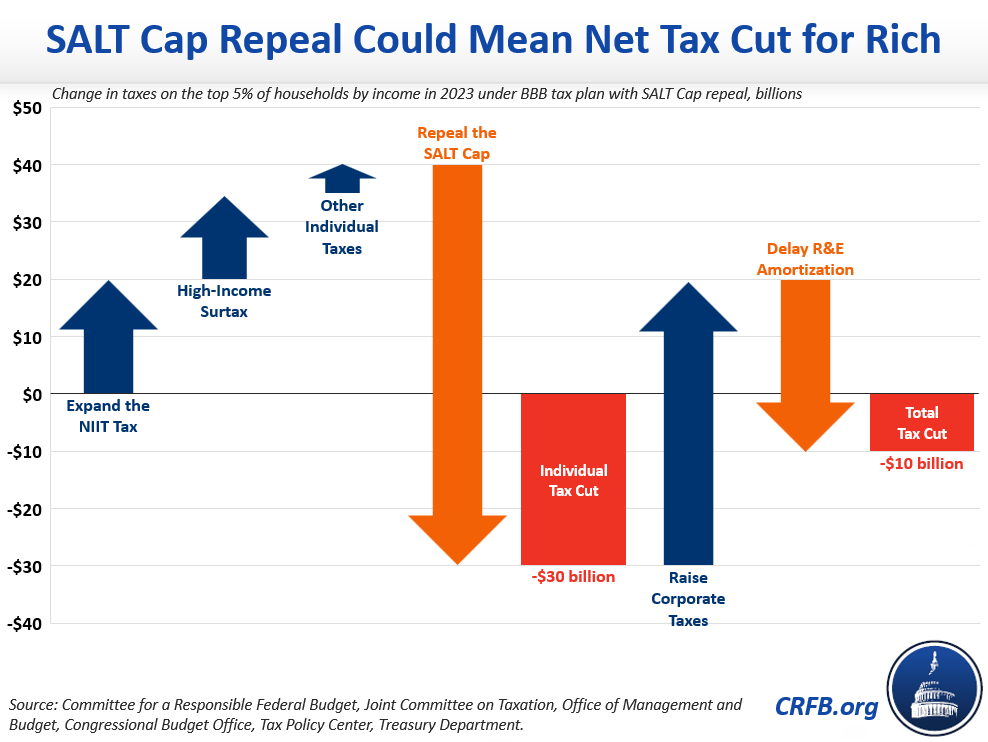

The investment income above the 250000 NIIT threshold is taxed at 38. 15 States Where the Most. Expansion of Net Investment Income Tax 4 Not applicable.

Strategies to Reduce Your Modified Adjusted Gross Income. 20 2019 Section 4940 a was amended to provide a single tax rate of 139 on net investment income and Section 4940 e was repealed. The net investment income tax will apply to a taxpayer only if their.

A the undistributed net investment income or. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. These individuals are also exempt from the 38 Medicare or net investment income tax NIIT which currently applies only to certain passive income and gains.

The IRS gives you a pass. Interest income from municipal bonds is federally tax. Calculating NIIT is not just as simple as multiplying your net investment earnings by 38.

Your modified adjusted gross income MAGI determines if you owe the net investment income tax. Overview Data and Policy Options Since 2013 certain higher-income individuals have been. April 28 2021 The 38 Net Investment Income Tax.

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. The adjusted gross income. You are charged 38 of the lesser of net investment income.

B the excess if any of. In the case of an estate or trust the NIIT is 38 percent on the lesser of. Internal Revenue Service Code Section 1411 imposes a 38 tax on a taxpayers net investment income.

President Joe Biden recently proposed a budget for 2022 that imposes a net investment income tax to help fund the main Medicare trust fund. The tax is calculated as 38 of the lesser of 1 net investment income and 2 the amount at which your MAGI exceeds the applicable threshold. September 13 2021.

A Married Filing Jointly household has 300000 in income from self-employment and. The Net Investment Income Tax in Practice. If the Supreme Court were to repeal Obamacare in part or whole it is possible that 38 tax on Net Investment Income and the 09 Additional Medicare tax under Obamacare.

Invest more taxable investment funds in municipal bonds. You can compute your MAGI by.

Capital Gains Tax In The United States Wikipedia

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

Low Tax Rates Provide Opportunity To Cash Out With Dividends

Expanding The Net Investment Tax Mostly Would Target Households Making 1 Million Or More

Impact Of Potentially Higher Estate Taxes And Repeal Of Income Tax Free Basis Step Up At Death Lion Street

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

The Budget Reconciliation Bill How Could It Change Family Tax And Estate Planning Livingston Haynes Certified Public Accountants

North Carolina Providing Broad Based Tax Relief Grant Thornton

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

What Is Net Investment Income Tax Overview Of The 3 8 Tax

Reconciliation May Deliver A Tax Cut To The Rich Committee For A Responsible Federal Budget

Year End Tax Planning For Biden Tax Plan

Net Investment Income Tax Niit Quick Guides Asena Advisors

Congress Readies New Round Of Tax Increases

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Net Investment Income Tax Other Taxes And Penalties Youtube

Understanding The Net Investment Income Tax Wheeler Accountants